Growing up in the UK in the ‘80’s I remember the song “Turning Japanese” by one-hit-wonder “The Vapors”. I remember there were fierce debates regarding the meaning of the lyrics and if you run a Google you will see the controversy still continues to this day. “No sex, no drugs, no wine, no women No fun…..” What? No fun? Well, some of the most fun I’ve had in years and a real true educational experience came from my first visit to Japan to visit Irving Resources Inc. on Hokkaido Island. Since I am in lockdown and unable to travel to Ecuador I thought I would vicariously take you on a field trip….

I was in Central Kazahkstan, running a drill programme on a porphyry Cu-Mo-Au deposit called Koktasjal when out of the blue I got a call from Brian Atkinson, the Resident Government Geologist in Red Lake, Ontario. “Duncan Riesmeyer, the VP of Santa Fe Canadian Mining, wants to talk to you about Springpole.” I didn’t think anyone even knew I was involved with Springpole, much less would want to talk to me about it. Duncan said he had read some published papers of mine from 1989 comparing Springpole with Cripple Creek in Colorado and thought I was “spot on”. Could I run a field trip for them at Springpole on my return to Canada? When things soured in Kazahkstan with the government I skedaddled back to Canada and before long was packed into a Cessna with Duncan and headed to Springpole Lake, 116 km NE of Red Lake. I had started my PhD thesis project on Springpole back in 1986, but early on had a divergence of opinion on the geology and got kicked off the project. The Project Geologist at the time said that it was shear-zone hosted and that the rock types in the area were irrelevant. I said that yes, it was all sheared up in places and hard to geologically unravel but that it was a typical epithermal environment as I had worked on in North Queensland in 1988. Duncan entirely agreed with me, and in December, 1996 I successfully defended my thesis, and memorialized Springpole in a 272 page tome recognizing it as possibly the world’s oldest epithermal deposit (2734 Million years).

Santa Fe had an option on the Springpole Property from Gold Canyon Resources, at the time run by mining promoter Michael Levinson, a hard-boiled New Yorker. I became friends with Michael and his lovely Japanese wife Akiko, and I remember at one point, Mike flew me down to New York to be the featured speaker at the Harvard Club to a lunch full of investors. One of my most vivid memories was a warthog in the foyer (now removed) that was shot by Teddy Roosevelt. Mike asked me to tell the audience that “There is more gold at Springpole than Busang.” As a matter of fact, there was (!), but we didn’t know at the time that Busang was a BreX scam. I of course declined.

About a year later a young geologist named Quinton Hennigh was hired by Gold Canyon and he contacted me several times requesting information on Springpole. He said he had read my thesis from cover to cover (probably the only person to do so, I don’t even think my examiners did). At the time I was off chasing diamonds in the jungles of Mato Grosso in Brazil so I was hard to get a hold of. In 2003 I heard that Michael Levinson had died from a massive heart attack on the tennis court and that Akiko had stepped up to run the company.

Fast forward from 2003 to October of 2016, when Chris Osterman, the CEO of the purchaser of Springpole reached out to me and gave me an update. Akiko had sold Springpole and spun out a Newco called Irving Resources. Later she would tell me it is named after her beloved pet cat. Irving’s paw features on the company logo! The flagship project is called Omu and is located on Hokkaido Island, the most northerly island of Japan, on the Sea of Okhotsk facing Russia.

Novo found gold at Purdy’s Reward in the Pilbara and broadcasted in a live feed from site to the Denver Gold Show. I told Quinton it was “the greatest piece of promotion since the days of Phineas Taylor Barnum.” I managed to catch up with him at Mines & Money and he invited me out to Karratha to see the Novo project in mid-November, 2017. There I met Haruo Harada, the Director of Mitsui, who was consulting for Irving at the time. I gave him a business card and asked him to pass it along to Akiko. A day or two later I got a lovely email from Akiko: “Quinton uses Fruta del Norte as an example of a blind deposit in Irving’s presentation as we believe we have in Hokkaido Japan, so it was very nice for Mr. Harada to meet with you, too. I am sure Quinton has already mentioned to you, but when we have a larger exploration program next year, it would be great if you could visit us at Omui Project in Japan as well.”

Akiko Levinson is rather diminutive in stature and modest in nature, but she hides an astute business mind. She told me that she purchased the Omui Mining Right from a Mr. Nanjo who from time to time had done some hand trenching on the Honpi Prospect. The elder Mr. Nanjo had optioned the property to Mr. Matsufuji in 1990s, who had paid $800,000 of a negotiated price of $1,200,000. When Akiko asked what the new price was, Mr. Nanjo said, “Well, $800,000 of the $1,200,000 has already been paid. So I want $400,000.” Such is the way business is conducted in Japan. It turned out that Mr. Matsufuji was an old friend of Akiko.

After Akiko’s note I was very intrigued and started to follow Irving (IRV) in earnest. I was soon rewarded. In January, 2018 IRV released results of stream sediment surveys over the Omu land package, followed closely in February by soil geochemistry over the Omui concession. This is where it got professionally interesting for me because the anomalies were clearly predominantly in “pathfinder elements”.

These are trace metals like mercury, arsenic and antimony with the weird ones you may have not heard of before like selenium, thallium and tellurium. Individually they can occur in many geological settings, but when they show “covariance” (they increase together over a sample distribution) they almost always indicate an epithermal gold or silver occurrence. They can be found however over a much wider area than the gold itself, so if you find them you know it’s likely the gold is close by (horizontally, or vertically in the subsurface). Pathfinders are extraordinarily useful.

Geologists can only learn how to find ore deposits by the successes and failures of those who went before them, rather like chefs develop recipes over time using what works and discarding what doesn’t work. We are especially fond of reading up on test cases from successes just like chefs use cookbooks. Ore deposit discovery is not randomly hiking through the jungle and then having a “Eureka moment”, as much as Hollywood likes to portray it that way. Quinton, who is Technical Advisor to IRV is an experienced geologist who had worked formerly for Newmont, and so I know he had learned a thing or two through excellent tutorage, however I was pleased when Akiko told me that he was using Fruta del Norte (FDN) as a test case in Hokkaido. FDN was a blind deposit found beneath an arsenic, antimony and mercury anomaly. I myself was using FDN as a test case for Aurania’s Lost Cities Project in Ecuador! (Note: I was responsible for designing the regional exploration programme in 2002-2004 that eventually led to the FDN discovery). Even though Omu is on a different continent, the same exploration methodology can be applied given evidence of similar geology.

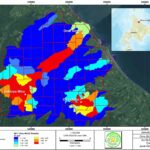

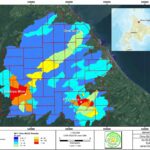

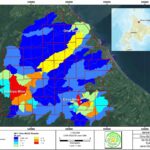

Irving Resources Omu BLEG Results by stream catchment.

Source: Irving Resources Ltd.

The colour-coded maps outline catch basins which are separated by hills or ridges. This makes life easy. If the area was flat or nearly so the dispersion of metals through stream erosion would potentially cover the entire area making it harder to interpret (but not impossible). They are best reviewed on the same sheet of paper. You see that the metals co-vary together as hoped for. The co-variance is never in lock-step for natural systems so not all the drainages are anomalous to the same degree. These plots tell me that there are at least 5 areas of interest. The three “hot zones” are around the Omu Sinter in the north, the old Hokuryu Mine in the southwest and the old Omui Mine in the southeast, but there are some more subtle anomalies in the far north, and between Omu and Omui.

Irving Resources Omui Property Soil Sample Results

Source: Irving Resources Ltd.

When the soil results are presented for Omui you can see that the hotspots for gold and silver are concentrated around the named locations, which are gold occurrences (or “showings”). No big surprise here and some of this may be old mine dumps or tailings. The really interesting plots however are for arsenic, antimony and selenium because the hot colours (yellow, orange and red) are indicating a NW-SE trend across the entire Omui concession (1.6 km). Even mercury is giving a hint of a NW-SE trend. This is powerful stuff, and when I reviewed it with my VP Exploration for Aurania, Jean-Paul Pallier, we were convinced that IRV were on to something. We ourselves have a cookie-cutter lookalike from Yawi and Crunchy Hill on our Ecuador Project, with the same anomalous suite of elements and broadly similar magnitudes of concentrations. In Irving’s case, arsenic, antimony and selenium are indicating “blind” mineralization, i.e. vein systems that themselves don’t come to surface but the geochemical dispersion halo does. Jean-Paul and I were anxious to see this firsthand, and so I contacted Akiko and took up her kind offer to visit the Project. The following are soil geochemistry plots from Aurania’s Latorre Zone (Crunchy Hill and Yawi Prospects) at the same intervals as the Irving plots from Omui. Note the scale bar of 6 kilometres.

Aurania Resources Soil Sample Results

Source: Aurania Resources Ltd.

JP and I hit the ground in September, 2018, and we got to see all the Hokkaido showings. We had an excellent trip hosted by Quinton, Takeshi, Haruo and Akiko, but I must say that EVERYTHING was covered in bamboo, stinging nettles or poison ivy! There is virtually no rock sticking up anywhere, and geological mapping is a waste of time unless it is done immediately after the snow goes and before the vegetation takes hold. At one of the prospects next to a river was a freshly killed and half-eaten salmon. I am positive that we scared a bear off without knowing it. Brown bears are common in the area and can reach large size.

First stop for us was the Honpi Prospect, which was a couple of shallow narrow trenches in a sea of metre-high bamboo scrub. The trenches were carved into sticky bright red mud and there was not much geology to see, but we were able to break off some samples of breccia with black ginguro bands. “Ginguro” is a mining term from Japan that has fallen into universal geology-speak and translates literally as “Black Silver”. It is usually very fine grained-electrum and silver sulphosalt minerals and when you see it, it means high grade.

Quinton told me that the Omu Sinter Prospect was something not historically examined. Driving on the outskirts of the town of Omu many of the houses have a large piece of white quartz as a prominent garden focal point. Curiosity got the better of Quinton one day and he knocked on a door and asked where it had come from. Quinton and Haruo located the outcrop a stone’s throw from the sea. I was told it runs about 1 g/t gold. It is comprised of laminated silica and breccias and in one place are preserved ripple marks.

The sample I took from the Honpi Trench ran an amazing 935 g/t gold and 5750 g/t silver (with 14.95 ppm natural mercury). I sent if off for assay at ALS Chemex in North Vancouver, a recognized geochemistry laboratory. I had a piece of it slabbed and you can see little shiny pinpoints of electrum all over it. (It’s not easy to photograph!) I had the piece analyzed at the Museum of Lausanne in Switzerland, and it came back as electrum of composition 45.3% Au and 54.7% Ag with selenium-bearing acanthite (a silver mineral) and bromargyrite, which is a rare green silver-bromine mineral. I donated my sample to the Museum and it is now part of their collection. This is the highest gold assay of a sample I have personally taken, in my professional career!

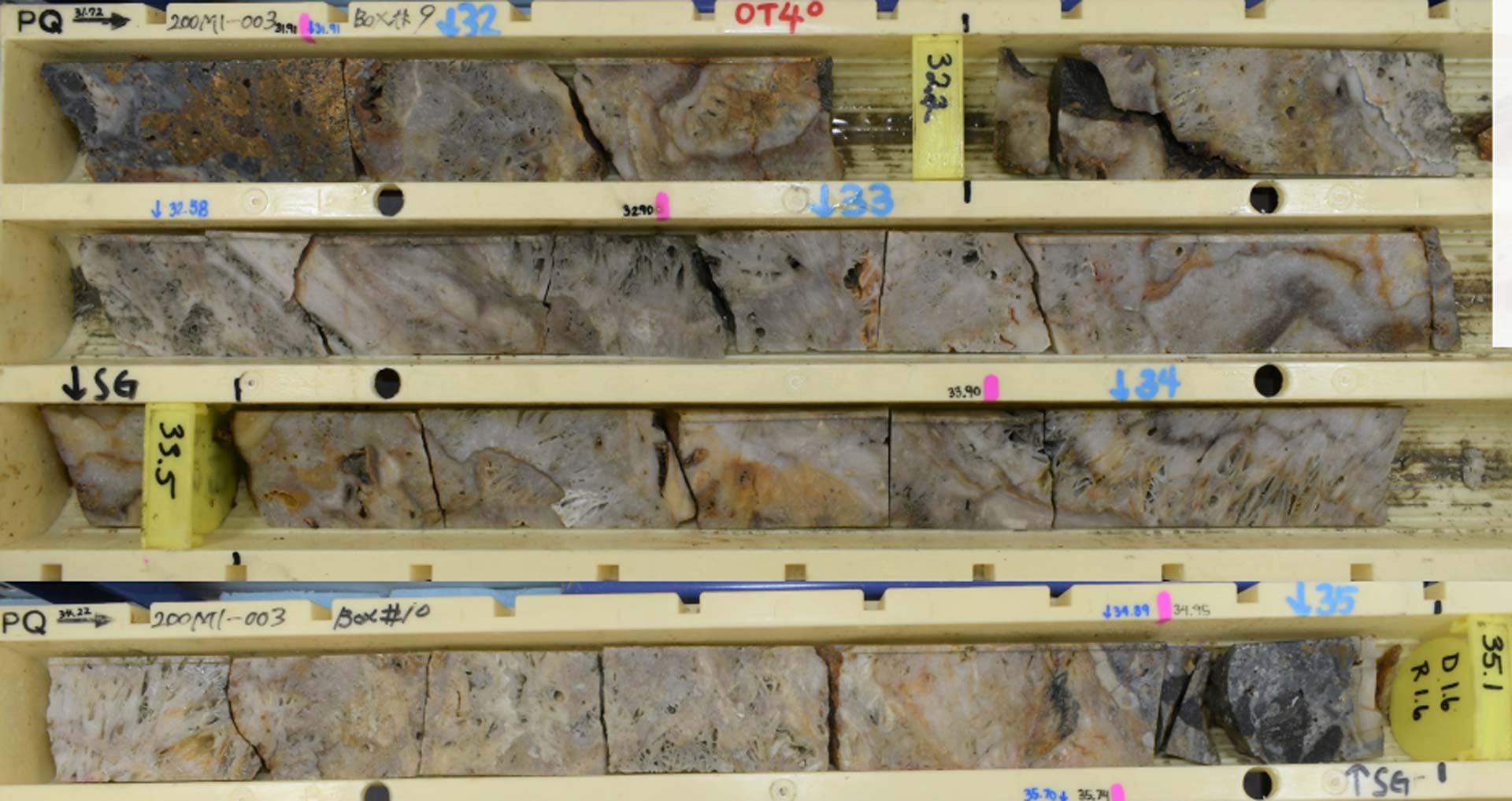

Most recently I saw the Irving Gang again at the Resource Investment Conference in Vancouver in January, and at the PDAC in Toronto just before the Covid lockdown. In Vancouver they had some boxes of drill core on display from the Omu Sinter.

In the meantime, the first phase of drill holes had been put down on the Omu Sinter. No doubt Quinton was hoping for a blind discovery of high grade beneath the sinter as had been found at Fruta del Norte by Aurelian, and many years before by Homestake at McLaughlin in California. Essentially, he was drilling “blind” just to see the plumbing system beneath the sinter. Not exactly a “Hail Mary” exercise as Aurelian had done when it was on its last nickels, but pretty aggressive….and it worked out with an intersection of 0.32 metres of 118.5 g/t Au and 1410 g/t Ag showing ginguro bands in Hole 002 (press release May 6, 2019). Newmont Goldcorp came in with a placement of $6 million USD even before assays were released.

Newmont got in a huddle with the Irving folks and advised them to do a CSAMT survey (controlled source audio-frequency magnetotellurics) over Omu and Omui which was done last August. This was done to show electrically resistive (and presumably silica rich veins) in the subsurface to better target or “snipe” (Quinton’s term) at the mineralization. Presumably using the geophysical results Irving started to target drill at Omui, and on February 7th, announced hole 19OMI-010 with 21 significant Au-Ag veins. Newmont dumped more money in (February 13, 2020 Press Release). After a Covid hiatus, Irving got back to work and announced (June 25, 2020 Press release) partial assays from 20OMI-001, and descriptions and photos of core from 002 and 003, all drilled at Omui. Sumitomo Corporation closed a placement for $2.5 million USD June 29th and now we are in “wait and see mode”. They don’t call the diamond drill the “truth machine” for nothing!

I am waiting to see what a 22.6 metre intersection (205.8 m to 228.4 m) in Hole 20OMI-003 runs. I just finished a webcast series on Epithermal Gold-Silver which is in editing mode now where I spoke specifically on “Boiling Zones” (Module #6 – Stay Tuned!) Those crisscross structures you can see, particularly in the bottom row are classic lattice calcite replacement texture and evidence that geothermal fluids boiled. This is your typical “drop zone” for gold as the fluids are chemically destabilized by boiling.

Philosopher George Santayana famously said, “Those who cannot remember the past are condemned to repeat it.” A friend of mine confused him recently with Carlos Santana (which made me howl!) Geologists learn from other’s successes; or they should! Aurania is taking a page out of Irving’s book and as soon as the Covid cautions are lifted we will be doing our own CSAMT survey to “snipe” at the mineralization. We know from the work done so far at Yawi and Crunchy Hill that the fluids trapped in veins at shallow levels “boiled”. It remains to be seen where the boiling took place in vertical space. Hopefully that is our “drop zone”.

And this is where I am going to pause the story…….

For purposes of disclosure I am the Chairman and CEO of Aurania Resources Ltd., and a circa 50% shareholder. I am also a shareholder of Irving Resources Inc. (<1%). I am not employed by Irving nor acting as agent or P.Geo for them.

The data presented in the graphics of pathfinder element concentrations in soil at Aurania’s Yawi and Crunchy Hill targets was presented in the NI 43-101 report entitled “A Technical Review of the Lost Cities – Cutucu Exploration Project, Morona-Santiago Province, Ecuador” [http://aurania.com/wp-content/uploads/2020/02/Aurania-Resources-NI43-101-Technical-Report-2020.pdf], but was modified in this article to replicate the colour scheme that Irving used for its soil data graphics.

Straight Talk On Mining Insights on mining from economic geologist Dr. Keith Barron.

Straight Talk On Mining Insights on mining from economic geologist Dr. Keith Barron.

I had the Vapors album. New Clear Day (I think a pun on Nuclear)

I also own some Irving, and more Novo